Conventional wisdom is that a central bank can anchor the long-run rate of inflation to a target of its own choosing. This belief is evident where ever a government has charged its central bank with a "price stability" mandate (commonly interpreted nowadays as keeping a consumer price index growing on average at around 2% per annum over long periods of time).

What exactly is the mechanism by which a central bank is supposed to control the long-run rate of inflation (the growth rate of the price-level)? And is it really the case that a central bank can defend its preferred inflation target without any degree of fiscal support?

Asking these questions reminds me of the old joke of an economist as someone who sees something work in practice and then asks whether it might also work in theory. In the present context one might point to the success that central banks have experienced with inflation-targeting. It works! And remember how the Fed under Paul Volcker (Chair from 1979-87) slew the 1970s inflation dragon with its Draconian anti-inflation policy? What else do we need to know?

Well, how did Volcker do it exactly? The conventional view is that Volcker tightened monetary policy sharply by contracting the rate of growth of the monetary base (which paid zero interest at the time). The unexpected shortfall in bank reserves led to a sharp increase in short-term interest rates and a severe recession (1981.2-1982.4). As is typically the case in a recession, the rate of inflation fell, a phenomenon commonly attributed to the decline in aggregate demand for goods and services as unemployment rises and as incomes fall.

But what kept the inflation low after the recession ended? Why did the inflation rate continue to decline as the economy grew (and as the unemployment rate fell)?

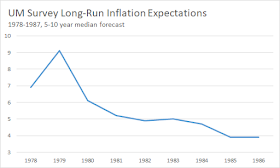

It's hard to argue that inflation expectations were declining. While inflation expectations fell with inflation from 1980-82, the median one-year-ahead inflation forecast from the University of Michigan survey remained flat at around 3% for the rest of Volcker's tenure. Although we have no direct market measure of long-term inflation expectations for that period, the 10-year treasury yield is probably not a bad proxy. And while the 10-year yield does decline in the 1981-82 recession, it remains elevated relative to historical (low inflation) norms and begins to rise in 1983 from just over 10% to 13.5% in 1984.

One could argue, I suppose, that the Volcker Fed kept inflation in check by raising its policy rate aggressively against signs of rising inflation expectations (the Fed had by this time abandoned targeting monetary aggregates). Thus, despite a growing economy, the Fed's interest rate policy kept realized inflation in check, even as expected inflation remained elevated.

Then, in the second half of 1984, long-term yields (long-term inflation expectations) began to decline. Shortly after, the Fed's policy rate declined as well. Inflation continued to decline modestly. All the while, the economy continued to grow (the unemployment rate continued to decline). Why did inflation remain low and why did inflation expectations decline?

One could argue, I suppose, that the aggressive action taken by the Fed in the first half of 1984 (not to mention the even more aggressive actions taken earlier in Volcker's tenure) finally convinced markets that the Fed was committed to keeping inflation low. This had the effect of keeping short-term inflation expectations low, which motivated wage and price setters to factor in lower cost increases. And it had the effect of lowering long-term inflation expectations, driving long-bond yields lower (as bondholders require less compensation against the loss of purchasing power of money due far in the future). The decline in longer-term inflation expectations c. 1984-85 also evident in the median 5-10 year forecast of inflation from the University of Michigan survey.

So that's the basic story. A central bank that credibly promises to snuff out any hint of rising inflation (and inflation expectations) can keep inflation anchored at a preferred long-run target of its choosing. Ironically, the threat of raising the short-term interest rate against inflationary pressure is what keeps nominal interest rates low. Moreover, if a central bank can credibly commit to a long-run inflation target, the effect is to keep longer-term bond yields low as well. The fact that things didn't work out so smoothly for Volcker early in his regime was because the Fed lost credibility in the 1970s and this credibility took time to rebuild.

I think there's a lot of merit to this view. But I still have a nagging doubt that U.S. fiscal policy had little or anything to do with Volcker's success at keeping inflation low. What exactly am I talking about--didn't Volcker accomplish his goal despite the Reagan deficits?

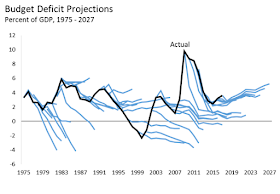

People tend to remember the famous Reagan tax cut (the Economic Recovery Act of 1981). The deficit grew very rapidly soon after because of the tax cut, but also because of the severe recession and also to some extent because of the Fed's high interest rate policy (which increased the interest expense of government debt). But as Justin Fox points out here, people frequently forget about the tax increases that came steadily throughout the Reagan administration (and into the Clinton years.)

As the diagram above shows, the year-over-year growth rate of nominal debt in April 1983 hit a peak of about 22%. The growth rate of debt turned around sharply after that, dropping to 14% in July 1984. After popping briefly to 17.5% in October of 1984, it started to decline, slowly at first, and then more sharply in 1986.

The ups and downs in the picture probably do not matter as much as the underlying trends. What matters is whether people generally believe fiscal policy to be anchored in the sense of keeping the long-run rate of nominal debt growth low. (Note: another notion of "anchored" fiscal policy corresponds to keeping the debt-to-GDP ratio stable, even though stability of this ratio is consistent with any inflation rate). If the claim is that the Volcker Fed could have lowered inflation permanently without fiscal accommodation, then it could have done so with debt continuing to grow indefinitely at (say) 20% per annum. There would have been no reason to reverse the Reagan tax cuts!

So, the thought experiment is this: suppose that the political pressure to reduce the Reagan deficits was absent. Could Volcker have kept inflation low?

Who knows what would have happened to economic growth. It may have gone up, down, or roughly followed the path it took. Let's take the middle ground and assume that growth would have remained unaffected. Let us further assume that the U.S. government is never going to default on its debt. (There is, of course, no reason for why a sovereign government issuing debt constituting claims against the currency it issues need ever default. If default does occur, it is a political decision and not an economic one.)

Alright, so now we have nominal debt growing at 20%. Suppose inflation does not change and suppose inflation expectations remain anchored. Then the Fed will have no reason to raise its short-term interest rate. And bondholders will have no reason to demand higher long-term yields. But lo, then there's a free lunch at hand. The government can simply use its paper to finance its expenditures without resorting to taxes. At best this might hold for a highly depressed economy, but it seems unlikely to hold for the case we are considering (robust economic growth and low average unemployment).

Something has to give. But what? If inflation and interest rates don't budge, then the public is being asked to hold an ever-increasing quantity of debt at the same real (inflation-adjusted) rate of interest. Assuming that the foreign sector doesn't fully absorb it, the increasing level of debt must crowd out domestic investment at some point. The private sector will attempt, at this point, to attract funding by offering higher returns on its debt-offerings. How does the real yield on government bonds rise if the nominal interest rate and inflation remain fixed? Is the Fed supposed to increase its policy rate in the face of declining investment (crowding out)?

One thing to keep in mind is that the permanent tax cuts will have made the private sector wealthier. It seems likely that at some point, they will want to spend this wealth. Of course, in aggregate, the public cannot dispose of the government bonds it holds--the bonds can only pass hand-to-hand. But this smells like a classic "hot potato" effect -- people will try to spend their wealth, driving the price-level higher (reducing the real value of the outstanding government debt).

So, suppose that inflation starts to rise (along with expectations of inflation). In response, the Volcker Fed increases its policy rate sharply and restates its commitment to keeping inflation anchored. The effect of the rate increase might be to slow economic growth and keep inflation in check for a while. But remember, the fiscal authority doesn't care in this thought experiment--it just keeps printing debt as rapidly as ever. The inflationary pressure has to return. So the Volcker Fed raises its policy rate again. And again. And again. And again. This is not going to work.

It is of some interest to note that Volcker himself did not appear to believe that the Fed could unilaterally keep inflation low. At least, I say this judging by the way he often criticized the Reagan administration for its loose fiscal policies. According to Volcker 1982 (see here), huge government deficits were responsible for high interest rates (the Fed's high-interest policy). In other words, fiscal policy was responsible for the price-level pressure that necessitated the Fed's high-interest rate policy.

The clash between the Fed and the administration at that time makes for some interesting reading (see also here). In light of the recent shift in fiscal policy, one wonders whether a similar conflict might be in the works in the not too-distant future.

What exactly is the mechanism by which a central bank is supposed to control the long-run rate of inflation (the growth rate of the price-level)? And is it really the case that a central bank can defend its preferred inflation target without any degree of fiscal support?

Asking these questions reminds me of the old joke of an economist as someone who sees something work in practice and then asks whether it might also work in theory. In the present context one might point to the success that central banks have experienced with inflation-targeting. It works! And remember how the Fed under Paul Volcker (Chair from 1979-87) slew the 1970s inflation dragon with its Draconian anti-inflation policy? What else do we need to know?

Well, how did Volcker do it exactly? The conventional view is that Volcker tightened monetary policy sharply by contracting the rate of growth of the monetary base (which paid zero interest at the time). The unexpected shortfall in bank reserves led to a sharp increase in short-term interest rates and a severe recession (1981.2-1982.4). As is typically the case in a recession, the rate of inflation fell, a phenomenon commonly attributed to the decline in aggregate demand for goods and services as unemployment rises and as incomes fall.

But what kept the inflation low after the recession ended? Why did the inflation rate continue to decline as the economy grew (and as the unemployment rate fell)?

It's hard to argue that inflation expectations were declining. While inflation expectations fell with inflation from 1980-82, the median one-year-ahead inflation forecast from the University of Michigan survey remained flat at around 3% for the rest of Volcker's tenure. Although we have no direct market measure of long-term inflation expectations for that period, the 10-year treasury yield is probably not a bad proxy. And while the 10-year yield does decline in the 1981-82 recession, it remains elevated relative to historical (low inflation) norms and begins to rise in 1983 from just over 10% to 13.5% in 1984.

One could argue, I suppose, that the Volcker Fed kept inflation in check by raising its policy rate aggressively against signs of rising inflation expectations (the Fed had by this time abandoned targeting monetary aggregates). Thus, despite a growing economy, the Fed's interest rate policy kept realized inflation in check, even as expected inflation remained elevated.

Then, in the second half of 1984, long-term yields (long-term inflation expectations) began to decline. Shortly after, the Fed's policy rate declined as well. Inflation continued to decline modestly. All the while, the economy continued to grow (the unemployment rate continued to decline). Why did inflation remain low and why did inflation expectations decline?

One could argue, I suppose, that the aggressive action taken by the Fed in the first half of 1984 (not to mention the even more aggressive actions taken earlier in Volcker's tenure) finally convinced markets that the Fed was committed to keeping inflation low. This had the effect of keeping short-term inflation expectations low, which motivated wage and price setters to factor in lower cost increases. And it had the effect of lowering long-term inflation expectations, driving long-bond yields lower (as bondholders require less compensation against the loss of purchasing power of money due far in the future). The decline in longer-term inflation expectations c. 1984-85 also evident in the median 5-10 year forecast of inflation from the University of Michigan survey.

So that's the basic story. A central bank that credibly promises to snuff out any hint of rising inflation (and inflation expectations) can keep inflation anchored at a preferred long-run target of its choosing. Ironically, the threat of raising the short-term interest rate against inflationary pressure is what keeps nominal interest rates low. Moreover, if a central bank can credibly commit to a long-run inflation target, the effect is to keep longer-term bond yields low as well. The fact that things didn't work out so smoothly for Volcker early in his regime was because the Fed lost credibility in the 1970s and this credibility took time to rebuild.

I think there's a lot of merit to this view. But I still have a nagging doubt that U.S. fiscal policy had little or anything to do with Volcker's success at keeping inflation low. What exactly am I talking about--didn't Volcker accomplish his goal despite the Reagan deficits?

People tend to remember the famous Reagan tax cut (the Economic Recovery Act of 1981). The deficit grew very rapidly soon after because of the tax cut, but also because of the severe recession and also to some extent because of the Fed's high interest rate policy (which increased the interest expense of government debt). But as Justin Fox points out here, people frequently forget about the tax increases that came steadily throughout the Reagan administration (and into the Clinton years.)

As the diagram above shows, the year-over-year growth rate of nominal debt in April 1983 hit a peak of about 22%. The growth rate of debt turned around sharply after that, dropping to 14% in July 1984. After popping briefly to 17.5% in October of 1984, it started to decline, slowly at first, and then more sharply in 1986.

The ups and downs in the picture probably do not matter as much as the underlying trends. What matters is whether people generally believe fiscal policy to be anchored in the sense of keeping the long-run rate of nominal debt growth low. (Note: another notion of "anchored" fiscal policy corresponds to keeping the debt-to-GDP ratio stable, even though stability of this ratio is consistent with any inflation rate). If the claim is that the Volcker Fed could have lowered inflation permanently without fiscal accommodation, then it could have done so with debt continuing to grow indefinitely at (say) 20% per annum. There would have been no reason to reverse the Reagan tax cuts!

So, the thought experiment is this: suppose that the political pressure to reduce the Reagan deficits was absent. Could Volcker have kept inflation low?

Who knows what would have happened to economic growth. It may have gone up, down, or roughly followed the path it took. Let's take the middle ground and assume that growth would have remained unaffected. Let us further assume that the U.S. government is never going to default on its debt. (There is, of course, no reason for why a sovereign government issuing debt constituting claims against the currency it issues need ever default. If default does occur, it is a political decision and not an economic one.)

Alright, so now we have nominal debt growing at 20%. Suppose inflation does not change and suppose inflation expectations remain anchored. Then the Fed will have no reason to raise its short-term interest rate. And bondholders will have no reason to demand higher long-term yields. But lo, then there's a free lunch at hand. The government can simply use its paper to finance its expenditures without resorting to taxes. At best this might hold for a highly depressed economy, but it seems unlikely to hold for the case we are considering (robust economic growth and low average unemployment).

Something has to give. But what? If inflation and interest rates don't budge, then the public is being asked to hold an ever-increasing quantity of debt at the same real (inflation-adjusted) rate of interest. Assuming that the foreign sector doesn't fully absorb it, the increasing level of debt must crowd out domestic investment at some point. The private sector will attempt, at this point, to attract funding by offering higher returns on its debt-offerings. How does the real yield on government bonds rise if the nominal interest rate and inflation remain fixed? Is the Fed supposed to increase its policy rate in the face of declining investment (crowding out)?

One thing to keep in mind is that the permanent tax cuts will have made the private sector wealthier. It seems likely that at some point, they will want to spend this wealth. Of course, in aggregate, the public cannot dispose of the government bonds it holds--the bonds can only pass hand-to-hand. But this smells like a classic "hot potato" effect -- people will try to spend their wealth, driving the price-level higher (reducing the real value of the outstanding government debt).

So, suppose that inflation starts to rise (along with expectations of inflation). In response, the Volcker Fed increases its policy rate sharply and restates its commitment to keeping inflation anchored. The effect of the rate increase might be to slow economic growth and keep inflation in check for a while. But remember, the fiscal authority doesn't care in this thought experiment--it just keeps printing debt as rapidly as ever. The inflationary pressure has to return. So the Volcker Fed raises its policy rate again. And again. And again. And again. This is not going to work.

It is of some interest to note that Volcker himself did not appear to believe that the Fed could unilaterally keep inflation low. At least, I say this judging by the way he often criticized the Reagan administration for its loose fiscal policies. According to Volcker 1982 (see here), huge government deficits were responsible for high interest rates (the Fed's high-interest policy). In other words, fiscal policy was responsible for the price-level pressure that necessitated the Fed's high-interest rate policy.

The clash between the Fed and the administration at that time makes for some interesting reading (see also here). In light of the recent shift in fiscal policy, one wonders whether a similar conflict might be in the works in the not too-distant future.

Great post.

ReplyDeleteI have always thought the "market expectations" explanation of inflation a weak plank.

Surely, the vast majority of businesses set prices in the present at what the market will bear. If five people knock on my door to rent an empty apartment within minutes of the Craigslist ad going up, I will charge what the market will bear.

Likewise, if Cushing is glutted, oil prices will come down.

If we assume competition, then prices are set by the market in the present, and anyone anticipating future deflation or inflation will get cut off at the pass.

Then we have the problem of…who is paying attention to the central bank? What fraction of the population could pick Jerome Powell out of a NYC mug lineup? Of that group, how many know what is QE? And of that group, do they believe QE is effective or not?

At this point, are we are down to a few thousand people in the US….they set the market? I never knew I was so powerful.

Lastly, there is a bit of the tautology in the market expectations story.

If inflation stays near 2%, we say the market expects the Fed to keep inflation near 2%.

If inflation stays under 1% (as in Japan) we say the market is not confident in the BoJ. The BoJ has bought 45% of JGBs, keeps interest at zero on 10-year Treasuries, and pays negative interest on some reserves. Importantly, they have not gone to helicopter drops. Maybe that is the key.

But if inflation should rise to 3% in Japan, then we would say the market thinks the BoJ has lost control.

This strikes me as a very convenient way of thinking…but is it right?

I guess if the market absolutely trusts the Fed, then it could print money with abandon, and the economy would boom---until businesses were rationing products and services by long lines or lotteries.

As for deficits, I do not know.

Japan appears to be able to monetize its JGBs. I call it Mobius Strip economics. So who is the money owed to? The government of Japan owes the money to the government of Japan. And still they have near deflation.

At worst I think the "market expectations" is merely a story line liked by some, another reason for long-faced central bankers to apply the monetary noose.

I suspect orthodox macroeconomics is losing a grip on how the economy really works. Something does not add up.

Either the government defaults on its debt, or the Fed "defaults" on its inflation target by printing enough to service and rollover the debt. Pick one.

ReplyDeleteYou are basically correct. The only twist is if treasury debt is de facto money (either directly, or monetized via banking sector). Then Fed printing is irrelevant (and inflation is not in control of Fed).

DeleteSuppose there are two media of exchange, but only one of which is unit of account, and they have different interest-elasticities of demand. The Fed can manage a price-discrimination strategy by varying the relative supplies of the two assets, even if we hold PV[budget surpluses] constant. So not irrelevant. (But might get wrong sign, though I can't do the math in my head, like Unpleasant Monetarist Arithmetic.)

DeleteLoyo (1999) argues that seigniorage revenue played little role in Brazilian inflation http://sims.princeton.edu/yftp/Loyo/LoyoTightLoose.pdf

ReplyDeleteFiscal theory of price-level (which is distinct from Unpleasant Moneterist Arithmetic, because in former, debt is nominal) it is the price-level that adjusts to equilibrate demand for real money/bond holdings with nominal supply. So, in fact, I take back what I said earlier in agreeing with you -- it is not necessarily the case that the government must default if central bank does not "print money" (swap one type of nominal liability for another). The price level can just rise via a standard hot potato effect.

Really?

ReplyDeleteReally?

How about the government buys the debt back...but there is not much inflation. The Japan model?

I address Japan in this post: http://andolfatto.blogspot.com/2016/11/the-failure-to-inflate-japan.html

DeleteAdd on:

ReplyDeleteSee these Fed papers below that say QE is not inflationary, in part as it buys assets that back currency (the Dallas Fed paper).

----30----

From St Louis Fed. The October version of the paper below was even more provocative:

https://research.stlouisfed.org/wp/more/2013-028

Then we have the Dallas Fed team and they posit that QE buys assets that back currency, like the Deutschen Rentenback after Weimar Republic.

https://www.dallasfed.org/~/media/documents/research/eclett/2014/el1406.pdf

And from NY Fed

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr527.pdf

a synopsis of the St Louis paper

QE/LSAP is actually anti-inflationary, asserts Wen of St Louis:

“Our model provides an alternative explanation for the low inflation level. The Federal Reserve’s LSAP alone can depress inflation near the liquidity trap: Once the real interest rate of financial assets is low enough, QE induces flight to liquidity because portfolio investors opt to switch from interest-bearing assets to money. Hence, the aggregate price level must fall to accommodate the increased demand for real money balances for any given target level of long-run money growth…”

BTW, the QE can be permanent, no matter, says Wen.

---30---

OK. So the Fed buys back debt and it is not inflationary there is a third option to inflation, or default.

I'm not sure what motivated these comments. What are they in reference to?

DeleteOK I read your Japan post, very thoughtful.

Delete"In my view, the appropriate contingency plan would involve a promise to use nominal debt to finance (say) social security payments or tax cuts as long as inflation remains below target. This is essentially "helicopter money." The "money" in this case is government debt (whether the BOJ monetizes new debt or not is irrelevant if the two objects are perfect substitutes)."--DA

Very close to Bernanke's 2003 presentation in Japan, in which he suggested:

“Consider for example a tax cut for households and businesses that is explicitly coupled with incremental BOJ purchases of government debt—so that the tax cut is in effect financed by money creation.”

https://www.federalreserve.gov/boarddocs/speeches/2003/20030531/

I like this approach.

I am only a wag, but as far back as 2008 I suggested money-financed tax cuts for the Social Security system. In other words, cut FICA taxes and print (digitize) the money to make up for revenue losses.

This would have the extra advantage of lowering the cost of employment, increasing the rewards for working, and being a tax cut only on productive people and enterprises.

My view now is, "Why keep your best player on the bench?"

Money-financed FICA tax cuts should be the first fiscal-monetary tool applied early into a recession, or even as a prophylactic.

Only convention, and perhaps a large dollop of establishment, crony capitalism, interest-group politics, and a shot of class bias stand in the way.

Instead of money-financed FICA tax cuts, let's stuff the commercial banks full of interest-bearing reserves!

I'm not sure what motivated these comments. What are they in reference to?--DA

ReplyDeleteI am responding to this comment by Nick Rowe:

"Either the government defaults on its debt, or the Fed "defaults" on its inflation target by printing enough to service and rollover the debt."

As a practical matter, if not in theory, evidently there is a third option, and that is that a government can do some amount of QE and build the central bank balance sheet. It neither defaults on the national debt, not does QE seems to cause inflation.

"remember how the Fed under Paul Volcker (Chair from 1979-87) slew the 1970s inflation dragon with its Draconian anti-inflation policy?"

ReplyDeleteThat's a blatant lie. Paul Volcker’s version of monetarism (along with credit controls: the Emergency Credit Controls program of March 14, 1980), was limited to Feb, Mar, & Apr of 1980. Even with the intro of the DIDMCA, total legal reserves increased at a 17% annual rate of change, & M1 exploded at a 20% annual rate (until 1980 years’-end).

Why did Volcker fail? This was due to Volcker's operating procedure. Volcker targeted non-borrowed reserves when at times 10 percent of all reserves were borrowed (no change from what Paul Meek, FRB-NY assistant V.P. of OMOs and Treasury issues, described in his 3rd edition of “Open Market Operations” published in 1974.. One dollar of borrowed reserves provides the same legal-economic base for the expansion of money as one dollar of non-borrowed reserves. The fact that advances had to be repaid in 15 days was immaterial. A new advance could be obtained, or the borrowing bank replaced by other borrowing banks.

It was before the discount rate was made a penalty rate in Jan 2003. And the fed funds "bracket racket" was simply widened, not eliminated. Monetarism actually has never been tried.

Then came the "time bomb", the widespread introduction of ATS, NOW, & MMMF accounts at 1980 year end -- which vastly accelerated the transactions velocity of money (all the demand drafts drawn on these accounts cleared thru demand deposits (DDs) – except those drawn on Mutual Savings Banks (MSBs), interbank, & the U.S. government).This propelled nominal gNp to 19.2% in the 1st qtr 1981, the FFR to 22%, & AAA Corporates to 15.49%.

By the first qtr of 1981, the damage had already been done. But Volcker errored again (supplied an excessive volume of legal reserves to the banking system), in late 1982-83.

Nobody talks about the velocity of circulation. It's one of the most important determinants of economic growth.

ReplyDeleteNobody understands the mechanics of money velocity.

Ignore income velocity, Vi, money velocity is a transactions concept, Vt. The transactions velocity, Vt, is an “independent” exogenous force acting on prices.

Most of this “S-Curve” dynamic damage (sigmoid function), was done by the first half of 1981, with the widespread introduction of new negotiable demand drafts, e.g., the effervescent “saturation value” of ATS, NOW, and MMDA accounts.

Thus, began secular strangulation (as predicted in 1961). The decline in money velocity is identifiable. It is particularly traceable to the decline in savings put back to work. This is due to the preponderance of bank-held savings, funds that are un-used and un-spent, lost to both consumption and investment. Why? Because from the standpoint of the entire economy, the DFIs always create new money whenever they lend/invest. They do not loan out existing deposits saved or otherwise.

That is the error in Keynes' General Theory. In almost every instance in which Keynes wrote the term bank in the General Theory, it is necessary to substitute the term financial intermediary in order to make his statement correct.

The upshot? Prepare for a depression.